How much is the Reebok brand worth after being offloaded by Adidas?

When Adidas acquired Reebok in 2006 it claimed its brand value stood at €1.7bn, but in its latest financial statement that figure had dropped to €733m, so what is new owner Authentic Brands getting?

After 15 years under Adidas ownership, the sportswear giant is close to selling off the Reebok brand – but at a loss. While Adidas has followed Nike on an upward trajectory over the past decade and a half, Reebok has struggled to match their growth momentum.

After 15 years under Adidas ownership, the sportswear giant is close to selling off the Reebok brand – but at a loss. While Adidas has followed Nike on an upward trajectory over the past decade and a half, Reebok has struggled to match their growth momentum.

Adidas bought the brand in 2006 for €3.1bn (£2.6bn) as part of its effort to take on Nike, but now looks likely to sell the brand for €2.1bn (£1.8bn) to Authentic Brands Group early next year.

According to brand valuation consultancy Brand Finance, Adidas’s brand is now worth around half as much as Nike’s at €12.2bn (£10.4bn), up from a third in 2007 when it was €4.8bn (£4.1bn).

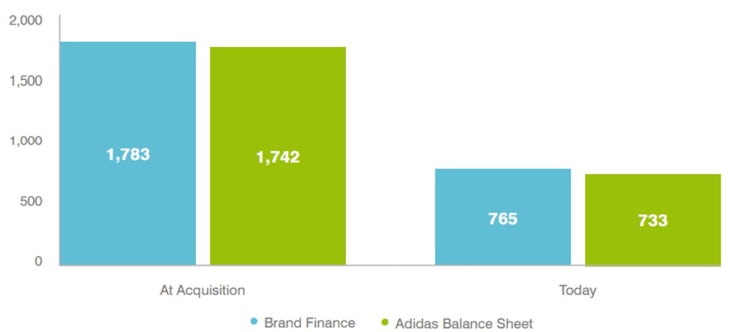

However, the value of Reebok’s brand has dropped significantly. In 2006, Adidas claimed Reebok’s brand value stood at €1.7bn, but in its latest financial statement, that figure stands at just €733m.

Similarly, Brand Finance’s first measurement of the Reebok brand in 2008 valued it at €1.8bn (£1.5bn), while its latest valuation in January this year estimated the value at €765m (£651m).

The health of Reebok’s brand has also taken a hit over recent years, according to YouGov’s BrandIndex tool. Although its overall index score – a measure of brand health covering impression, quality, value, satisfaction, likelihood to recommend and reputation – is well ahead of the sports retailer sector on average, since August 2011 it has dropped from 21.5 to 17.3.

The health of Reebok’s brand has also taken a hit over recent years, according to YouGov’s BrandIndex tool. Although its overall index score – a measure of brand health covering impression, quality, value, satisfaction, likelihood to recommend and reputation – is well ahead of the sports retailer sector on average, since August 2011 it has dropped from 21.5 to 17.3.

Comparatively, Adidas’s index score has dropped just 0.9 points to 28.1. Nike claims a score of 27.7.

Reebok also scores lower than Adidas and Nike on quality with a score of 21.9, compared to 38.8 for Nike and 36.2 for Adidas. It is, however, superior to Nike on value with a score of 11.2, though it does not beat Adidas’ score of 13.3.

And while consumers are again more likely to consider buying from Reebok than most other sports retailers, its consideration score still falls short of its closest rivals, with a score of 18.1 compared to 32.4 for Adidas and 35.7 for Nike.

With this change in ownership, we believe the Reebok brand will be well-positioned for long-term success.

Kasper Rorsted, Adidas

However, Reebok’s declining value and health appears not to have put off Authentic Brands, which is preparing for an IPO in the coming months. The group also recently acquired Forever 21, Brooks Brothers and Aeropostale.

Jamie Salter, founder and CEO of Authentic Brands, says it plans to strengthen the Reebok business and maintain its retail outlets.

“It’s an honour to be entrusted with carrying Reebok’s legacy forward,” he says. “This is an important milestone for ABG, and we are committed to preserving Reebok’s integrity, innovation and values – including its presence in bricks and mortar. We look forward to working closely with the Reebok team to build on the brand’s success.”

On selling the brand, Adidas AG CEO Kasper Rorsted says Adidas will now focus its efforts on executing its ‘Own the Game’ strategy in order to grow.

“Reebok has been a valued part of Adidas and we are grateful for the contributions the brand and the team behind it have made to our company,” he adds. “With this change in ownership, we believe the Reebok brand will be well-positioned for long-term success.”

Comments