Amazon retains crown as world’s most valuable brand

Amazon tops Kantar BrandZ’s list of the world’s 100 most valuable brands for the third year in a row, as a host of global businesses bounce back with a vengeance despite the trials of lockdown.

Amazon has been crowned the world’s most valuable brand for the third year in a row, according to the Kantar BrandZ 2021 Top 100 ranking.

Amazon has been crowned the world’s most valuable brand for the third year in a row, according to the Kantar BrandZ 2021 Top 100 ranking.

The success of the ecommerce giant comes amid a record year of growth for brands on the ranking. Overall, the top 100 brands grew four and a half times higher than in a typical year and collectively are now worth $7trn, more than the GDPs of France and Germany combined.

This growth has been prompted in part by increased optimism about a possible end to the pandemic, as well as steps taken by the US government to boost the nation’s economic prospects post-lockdown.

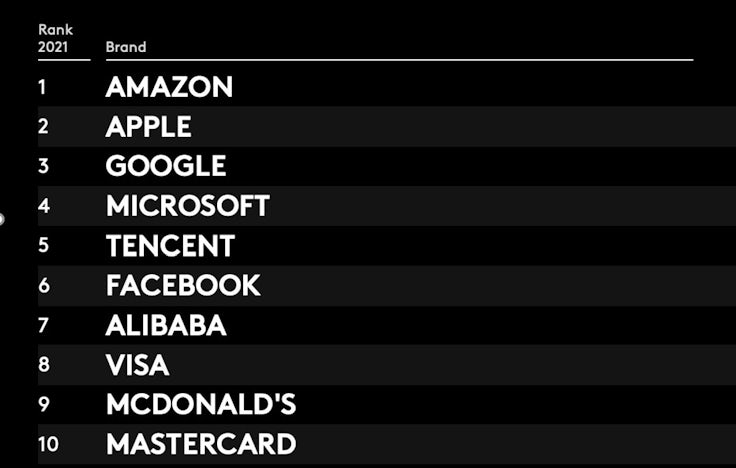

When it comes to the ranking, Amazon has a brand value of $683.9bn, up 64% compared to 2020. Apple follows in second place ($611bn, up 74%), with Google claiming third place ($458bn, up 42%) from now fourth placed Microsoft ($410.3bn, up 26%).

Chinese tech giant Tencent is in fifth place ($240.9bn, up 60%), followed by Facebook ($226.7bn, up 54%), Alibaba ($197bn, up 29%), Visa ($191.3bn, up 2%), McDonald’s ($154.9bn, up 20%) and Mastercard ($112.9bn, up 4%).

Global head of research at BrandZ Martin Guerrieria describes both Amazon and Apple’s growth figures as “genuinely astounding”.

“It’s the first time that we’ve had two brands that are worth more than half a trillion dollars, which is actually pretty scary when you think about the amount that they’re actually worth,” Guerrieria adds.

Looking at the wider top 10, only two brands – Visa and Mastercard – were in single-digit growth.

It is testament to the strength of these brands that they were able to bounce back after lockdown measures were lifted quicker than, for instance, Wall Street. The report highlights how brands were able to regain their positions of strength within 15 weeks of the first lockdown in March 2020, twice as fast as mainstream stock market indices.

“We had to check those numbers five times, because we just couldn’t believe it at first,” Guerrieria explains. “It’s quite amazing, the resilience of these brands.”

Flying high

For the first time this year, Chinese brands outnumber their European counterparts, with US and Chinese companies now accounting for 88% of the top 100. Furthermore, the domination of tech and its influence on retail, leisure and media continues unabated.

“I think we’ve now reached the point where technology is playing a role in practically all of the brand value growth that we’re seeing, whether you’re a grocery retailer or car manufacturer,” says Guerrieria.

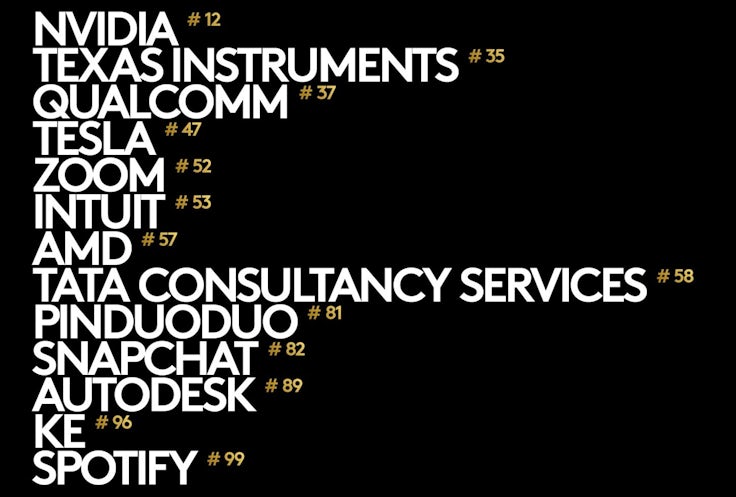

That’s reflected in the two brands that enjoyed the greatest value increase on the ranking. Tesla boasted a remarkable 200% uptick, while TikTok continued its meteoric rise with a 150% increase. The electric car brand’s figures were the best since Blackberry, back in 2009.

Despite the limitations of lockdown, Tesla has kept up its vital brand equity and launched a wider range of products. “The equity data suggests that its consumer relationships and perceptions have absolutely strengthened. It feels like the year that it’s tipped into the mainstream,” Guerrieria explains.

For UK brands, the misery continues. Vodafone, at 60, is the only entry in the 100. By contrast Sweden now has two brands in the ranking, with new entry Spotify claiming a place alongside Ikea.

Clearly, breaking into the top 10 next year will be a huge challenge for any brand, even those with the best equity investment and relevance. As Guerrieria points out, sitting tight and hoping any of those elite companies are going to somehow slip up isn’t going to work. But could any of the current highflyers have a chance?

“The likes of Tesla and TikTok, I think they could,” Guerrieria offers. “I’m not saying that it will be next year necessarily, but if you look at TikTok especially, it’s such a young brand and it’s achieved so much value so quickly, that with the right proposition it is possible.

“But for an FMCG brand to move into that top space, as things stand, that’s going to be really difficult.”

Methodology

Kantar’s BrandZ valuation process takes the financial value created by a brand in US dollars and multiplies it by brand contribution. The result is Brand Value – the dollar amount a brand contributes to the overall value of a corporation. Isolating and measuring this intangible asset reveals an additional source of shareholder value that otherwise would not exist.

That brand contribution is derived from consumer research that quantifies how much of the volume people purchase and how much of the price premium people pay can be attributed to brand equity, connecting what people think to what they do.

This year’s analysis involves 18,500 brands, 3.9 million consumers, 512 categories, 51 markets and 5.3 billion data points.

Comments